Understanding the differences between these digital coins can help traders to better understand the short-term and long-term potential of each currency.

All of the above-mentioned currencies have a ledger system that keeps track of each coin’s movement. This allows for individual verifiers on the network (nodes) to confirm that a transaction is legitimate and the payee is the rightful owner of the coins they are trying to pay with. This also applies to meeting criteria of Smart Contracts or other block-chain automatic payments.

The difference with XRP is that only 80% of nodes need to agree. This allows for transfers to run more smoothly with a lower potential for delays. On the other hand, having a unanimous consensus is a key feature that makes blockchain secure.

Uses XRP was designed as a currency to be used on Ripple’s blockchain platform.

For example, if a customer wants to transfer money to a merchant across the globe, they can either ask their bank to send the money through a web of bank relays, or they can convert the currency into XRP, where the merchant can receive it on the other end instantly.

While this is very convenient, a downside is that it forces an individual to pick XRP even if they already have Bitcoin, or another cryptocurrency. On the other hand, it protects the transaction by using a closed system and ensures a use case for those who hold the coin as an investment.

Processing speed

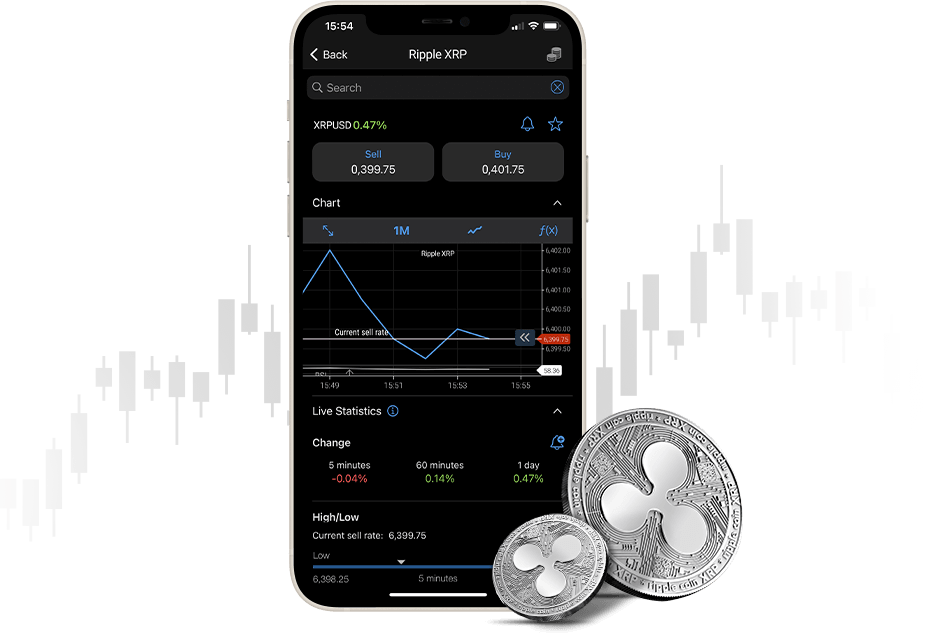

Ripple’s suite of products, including XRP, are designed to transfer money rapidly across the globe, similar to how credit cards work. Global recognition and speed are important to merchants who want to work internationally.

XRP can process 1500 transactions per second with an average ledger settlement (approval time) of 3-5 seconds. This is in comparison to Ether, which takes an average of 13 seconds, and Bitcoin, which can take around 10 minutes.

This speed makes XRP a practical currency for instant transactions in comparison to other leading cryptocurrencies.

Mining

XRP can not be mined.

Mining, the process of verifying transactions in exchange for the coin, is how validators are compensated on the Ethereum and Bitcoin networks.

Contrary to some other coins, Ripple destroys coins with each validated transaction, as a transaction fee.