A few more points on margins Several readers suggested that the reason margins are high and (I believe) sustainable is that the US economy is dominated by industrial , particularly in technology. This might be true. Certainly, rising margins always indicate something about competition.

It is only because competition is limited that all corporate gains in productivity and efficiency are not handed over immediately to the consumer. Software is not a great business just because its marginal cost of production is almost zero. It is a great business because its tiny marginal costs are paired with a legal system that protects intellectual property.

I no longer think we need to worry much about this. Ultimately, an uncompetitive economy will stop innovating and growing, and returns to investors must fall. But I’m not sure what we see in public markets is a degradation of competition as such. Rather, I’m beginning to think we are seeing the mix of public companies, and the mix of businesses within public companies, shift towards products that are brand, research and intellectual property intensive, and these products have higher margins.

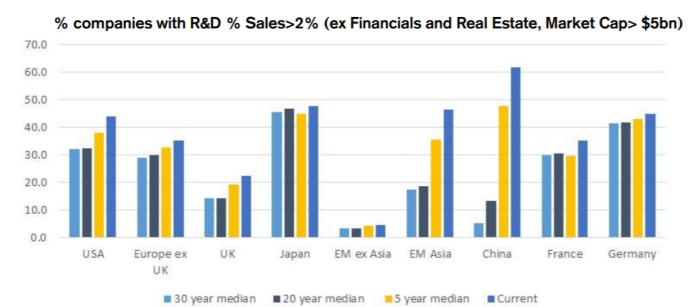

Here is a chart It shows the changing proportion of public companies in various markets that spend significantly on research and development.

I would also note that while tech companies are a big driver of rising margins, they are not the only ones. We have seen notable margin increases in, for example, industrials and consumer discretionary companies as well. Whatever sort of phenomena is unfolding, it is not restricted to tech. Other readers pointed to another, more pressing threat to margins: inflation. Paul O’Brien noted that while inflation does not cause margin degradation, “some inflationary forces — rising wages, supply constraints — are bad for margins. And higher inflation also can lead to tighter monetary policy and recession, also not good for margins.” He sent along this scatter chart, which plots profits as a share of gross domestic income against inflation (using data from the Federal Reserve). It shows a nasty trend when inflation gets much above 4 per cent: